At B. Johnson & Assoc., Ltd. we serve dozens of nonprofit entities each year. We have the knowledge to make sure that all of the information required to be filed with the IRS is complete and accurate.

Whether you are:

- a small entity that only needs to file and e-postcard with the IRS

- a larger organization that needs to prepare a form 990EZ

- a large organization that needs to file a complete form 990

Our staff of highly trained CPAs will ask you all the right questions to make sure that all of your filings with the IRS, the Minnesota Secretary of State and Attorney General’s office are all kept up to date.

If your organization is involved in lawful gambling we have the ability to:

- prepare monthly tax returns

- file them with Minnesota Revenue and the Minnesota Gambling Control Board

- incorporate the appropriate information into your required federal form 990 and 990T and your annual Minnesota M4NP filing

- report all of your related and unrelated business activity to the proper taxing agencies

No organization is too big or too small and we pride ourselves in providing the highest quality of service at very affordable rates to allow your organization to spend more on your program services related to your exempt function and less on administrative costs.

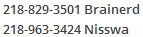

Contact us today.