Whether you have a sole proprietorship, partnership, corporation or an LLC, you are in good hands at B. Johnson & Assoc., Ltd. Preparing returns for over 1,000 businesses annually provides our highly trained staff of CPA’s a wealth of knowledge when it comes to preparing the appropriate forms and making the appropriate elections to be certain that your business is getting all of the deductions and credits it is entitled to.

With each CPA receiving more than 40 hours of training on changes to state and federal income tax laws each year, we are confident in our ability to prepare your business tax returns regardless of their complexity. We pride ourselves in taking the time to plan ahead and ask the right questions so you know the entity choice that will work the best for you as you start your business and when it is the right time to make a switch to a new entity as your business grows. We know the ins and outs of the tax laws and regulations so you don’t have to.

We look forward to working with old friends as well as with businesses that are new to the area. With our ability to analyze your data to plan ahead and prepare returns from every state, regardless of how much your business grows you will never need to go anywhere else.

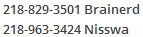

Contact us today.